Why Xitadel?

— Xitadel

For projects that have completed their Token Generation Event (TGE), the pressure to secure funding for ongoing development and growth remains immense. To raise capital, they often turn from public markets and rely on the secretive private OTC deals. While these deals offer quick cash, they are often offered at a steep discounts, which in turn creates huge selling pressure that destabilizes token prices and erodes investor trust.

Many top‑20 tokens now trade in the secondary OTC market at discounts close to 50%, often paired with a one‑year lock‑up. Tokens from projects outside the top 100 can be discounted as steeply as 70% off. For instance, a token listed at $1 on Binance might be sold for just $0.30 via STIX, subject to a one‑year lock‑up and an additional two years of monthly vesting.

| Project (Anonymized) | Discount vs. Market Price | Deal Valuation (FDV)* | Lock-up Period | Vesting Schedule |

|---|---|---|---|---|

| Project A | -53.00% | $1.1 Billion | 12 Months | 12 Months |

| Project B | -69.10% | $1.0 Billion | 6 Months | 24 Months |

| Project C | -61.10% | $380 Million | 12 Months | 36 Months |

| Project D | -60.00% | $1.3 Billion | 12 Months (Post-TGE**) | 36 Months |

| Project E | -60.00% | $330 Million | 12 Months (Post-TGE**) | 20 Months |

| Project F | -60.00% | $1.5 Billion | 12 Months (Post-TGE**) | 36 Months |

source: Presto Research

In April 2025, a top 20 ranked token plummeted by 90%, wiping out billions in market capitalization and leaving investors reeling in an hour. This isn't a hypothetical scenario; While the project’s co-founder pointed to "reckless forced closures" on exchanges, the crypto community pointed to a familiar culprit lurking in the shadows: large, heavily discounted Over-the-Counter (OTC) deals.

The "Lemons Market" Problem: Why Opaque OTC Deals Undermine Trust

This is more than just market volatility. This is a systemic problem economists label as a lemon market.

In 1970, economist George Akerlof published a groundbreaking paper, "The Market for 'Lemons'," which explained how markets can fail when one party has more information than the other. Using the used car market as his primary example, he showed that when buyers can't distinguish between high-quality cars ("peaches") and low-quality, defective cars ("lemons"), they are only willing to pay an average price. This price is too low for the owners of "peaches," so they leave the market. As a result, the market becomes flooded with "lemons," and overall quality collapses.

This is the exact problem plaguing the crypto markets today.

Blockchains are supposed to be transparent, yet critical information about a project's financial health is often hidden. Secret OTC deals, undisclosed insider allocations, and confusing vesting schedules create a fog of asymmetric information. Retail and institutional investors alike are left guessing. Are they buying into a "peach" project with a strong treasury and a long-term vision? Or are they buying a "lemon" project whose team has already sold off a massive, discounted chunk of its token supply to private investors who are waiting to dump on the market?.

This uncertainty forces rational investors to assume the worst and discount everything, which harms high-quality projects that are forced to trade at a lower value. As DeFiance Capital’s founder Arthur Cheong warned, this isn't an isolated anomaly but a systemic issue that is eroding confidence across the entire altcoin landscape.

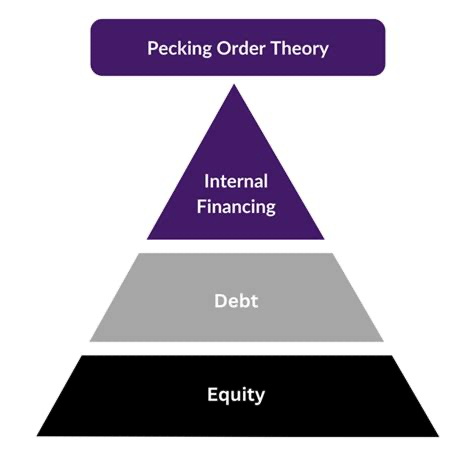

The Pecking Order Theory: Why Selling Tokens Is a Red Flag

The "lemons market" explains why trust breaks down. The Pecking Order Theory, first proposed by Stewart Myers and Nicolas Majluf, explains how a project's financing decisions reveal its hand. The theory states that due to information asymmetry, firms have a clear hierarchy for raising capital:

- Internal Funds (Retained Earnings): This is the first and best choice. It signals financial health and requires no disclosure of sensitive information.

- Debt Financing: If internal funds are insufficient, firms turn to debt. Taking on debt signals confidence to the market; managers believe their project is profitable enough to make repayments and that their equity (token) is currently undervalued.

- Equity Financing (Selling Native Tokens): This is the last resort. Selling native tokens is often interpreted as a negative signal. It suggests that management believes their own token is overvalued and that they are willing to dilute existing holders at a price they consider favorable.

When a Web3 project resorts to a discounted OTC token sale, it is choosing the final, most desperate option in the pecking order. This action sends a powerful, negative signal to the market, confirming investors' worst fears about information asymmetry. It tells the world that the team may lack confidence in the token's future value, creating the very conditions for the price instability and trust erosion that inevitably follow.

The Xitadel Solution: A New Paradigm for Treasury Financing

Xitadel was created to solve¡ this exact crisis of volatility and trust. It provides a transparent, structured, and compliant path for Web3 projects to finance their growth without resorting to dumping their native tokens on the market. Built on the high-performance Solana network, Xitadel introduces a novel financial instrument: Liquid Treasury Tokens (LTTs).

LTTs are tokenized, fixed-income products that are fully backed by a project's existing treasury assets.

Here’s how it works:

Collateralization, Not Sales: Instead of selling its native tokens, a project locks up idle assets from its treasury (mainly its governance tokens) in a smart contract on Xitadel. This locked-up capital serves as collateral.

Issuance of LTTs: The project then issues LTTs against this collateral. These LTTs represent a loan to the project, with a fixed yield and a set maturity date.

Funding: Investors purchase these LTTs, providing the project with the capital it needs for operations, development, and growth.

Redemption: At maturity, LTT holders redeem their tokens to receive their principal investment plus the agreed-upon yield.

The most critical strength of Xitadel’s model lies in its over‑collateralization. In practice, this means the value of assets locked in a project’s treasury always exceeds the total face value of issued LTTs. It’s essentially the same financial principle used in traditional fixed‑income markets.

For investors, this setup provides confidence. Risk is covered, exposure is explicit, and payouts are governed by smart contracts.

For foundations, it delivers liquidity without dilution. They unlock working capital without selling tokens into the market.

How Xitadel Differs from OTC: A Breakdown of Trust and Transparency

Xitadel’s model is fundamentally different from the opaque world of OTC funding. It replaces backroom deals with on-chain guarantees, building a system designed for trust and stability.

- Structured & Over-Collateralized vs. Discounted Secrecy Traditional OTC deals are conducted off-chain, with terms shrouded in secrecy. This opacity creates hidden risks that can surprise the market. Xitadel brings the entire process on-chain. Every LTT is backed by assets that are verifiably locked in a smart contract. Should the value of the collateral fall below a predetermined threshold, an automated liquidation process is triggered by a "Keeper Bot" to protect investors' capital. This mechanism replaces the counterparty risk of OTC deals with the certainty of code.

- On-Chain Transparency & Secondary Liquidity Every LTT issuance, trade, and redemption is recorded on the Solana blockchain, making it fully auditable by anyone at any time. This transparency eliminates the information asymmetry that defines the "lemons market." Furthermore, unlike illiquid OTC positions, LTTs are designed to be traded on decentralized secondary markets. This provides investors with liquidity and real-time price discovery, allowing them to manage their positions without being locked in until maturity.

- Flexible Structures: COIN-LTTs vs. USD-LTTs Xitadel recognizes that different projects have different treasury strategies and investor profiles. To accommodate this, the platform offers two distinct types of Liquid Treasury Tokens:

COIN-LTTs: Pay their yield in the project's native token at maturity. This is an excellent option for projects that want to reward their core community and long-term believers, allowing investors to increase their exposure to the native asset.

USD-LTTs: Pay their yield in stablecoins at maturity. This structure appeals to a broader range of investors, including more conservative funds, who are seeking predictable, fixed-income returns without taking on the volatility of a native token.

This flexibility allows teams to tailor their capital-raising strategy to their specific needs, bridging the post-TGE funding gap in a way that aligns with their long-term vision.

Building a More Sustainable Web3 Economy

The persistent cycle of opaque OTC deals and subsequent token crashes has created a crisis of confidence in the crypto markets. It has fostered a "lemons market" where even the most promising projects are viewed with suspicion, stifling innovation and harming investors.

Xitadel offers a clear path forward. By moving treasury financing on-chain, it replaces secrecy with transparency, counterparty risk with over-collateralized security, and toxic dilution with sustainable growth. Liquid Treasury Tokens (LTTs) provide a powerful new tool for Web3 projects to unlock the value of their idle assets without destabilizing their own ecosystems.

With its auditable framework and built-in investor protections, Xitadel is more than just a new DeFi protocol. It brings a fundamental shift in how Web3 projects can and should fund their futures by building a healthier, more transparent, and ultimately more trustworthy financial ground.