COIN-LTT vs. USD-LTT

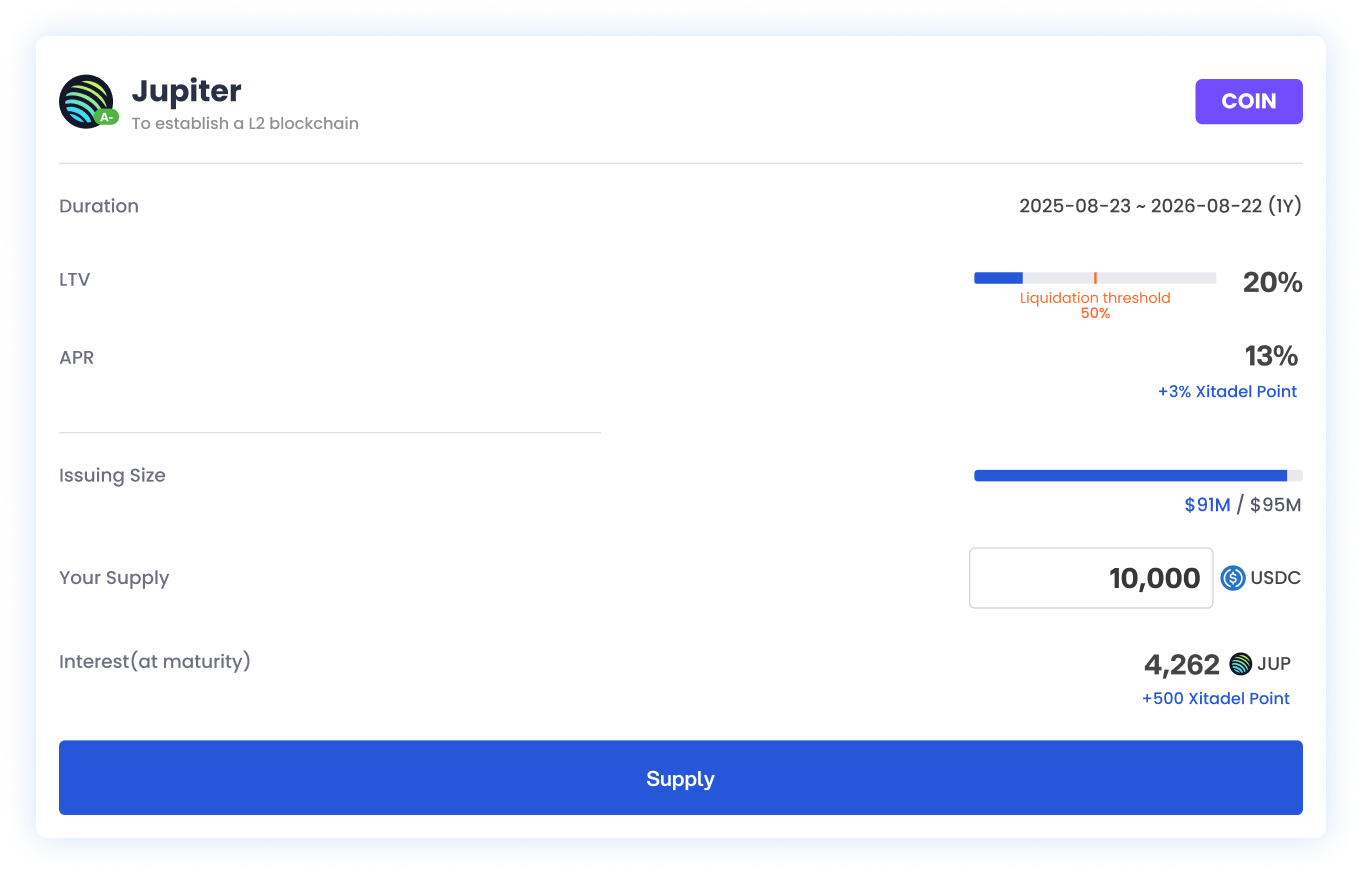

COIN-LTT

The Coin Type is a zero-coupon structure offered on Xitadel platform, where investors receive a fixed amount of native token as interest at maturity. This format provides a new way to earn benefit from potential token price appreciation while avoiding loss of principal.

For example, Jupiter may issue a Coin Type LTT to raise $100M with a 13% interest rate (with 5% LP Allocation). Upon maturity, investors receive their principal and interest in $JUP tokens, based on a fixed quantity determined at the time of issuance. Let’s assume the price of $JUP is 0.305 USDC when the LTT is issued. An investor who supplies 10,000 USDC would receive 4,262 JUP as interest at maturity, along with their principal.

The key characteristic of the Coin Type is that the amount of tokens to be distributed as interest is predetermined. This means the actual return for investors will fluctuate based on the token price at maturity.

If the price of $JUP increases by the time the LTT matures, the effective interest rate rises. Conversely, if the token price decreases, the realized interest rate falls. This dynamic makes the Coin Type a high-reward potential product for those bullish on the issuer’s token.

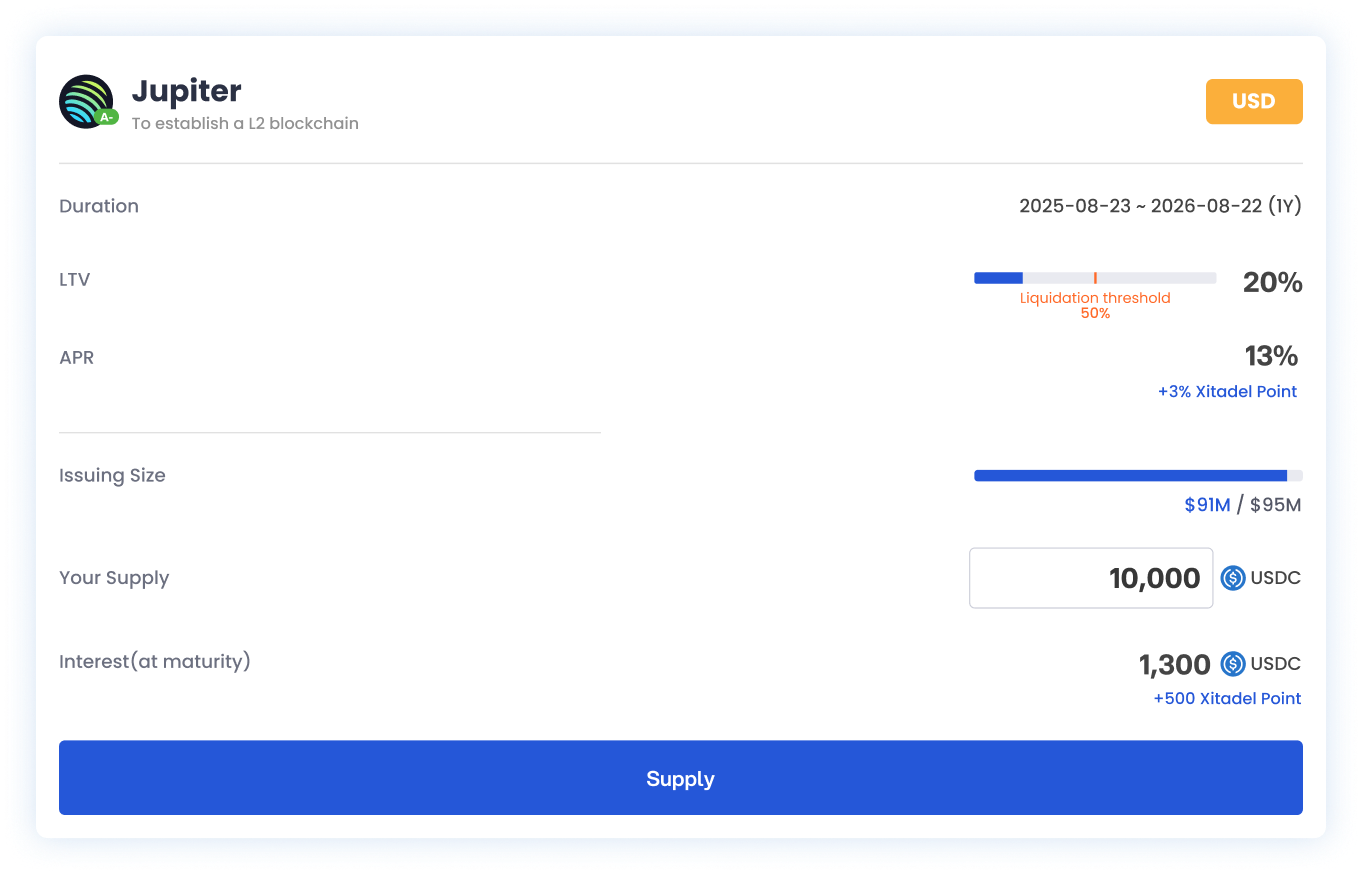

USD-LTT

The USD Type is also zero-coupon structure offered on Xitadel platform, where investors receive a fixed amount of stablecoin as interest at maturity. This format is designed to provide stable and predictable returns for investors who prefer to avoid the volatility of native tokens.

For instance, Jupiter may issue an LTT to raise $100M with a 13% interest rate (with 5% LP Allocation). Upon maturity, an investor who supplies 10,000 USDC would receive 1,300 USDC as interest, along with their principal. The fixed nature of the payout provides clarity and certainty, making it an appealing option for those seeking low-risk returns in the Web3 space.

Unlike the token-based (COIN-LTT) model where interest is paid in a fluctuating asset, the USD Type ensures repayment in stablecoins. It's similar to fixed-income instruments in traditional finance. This allows investors to lock in a predetermined yield, avoiding exposure to market volatility.

This two model enables Web3 projects like Jupiter to make idle treasury assets liquid in a predictable and structured way, while offering investors a familiar, stable return and bridging the gap between traditional finance and decentralized capital markets.