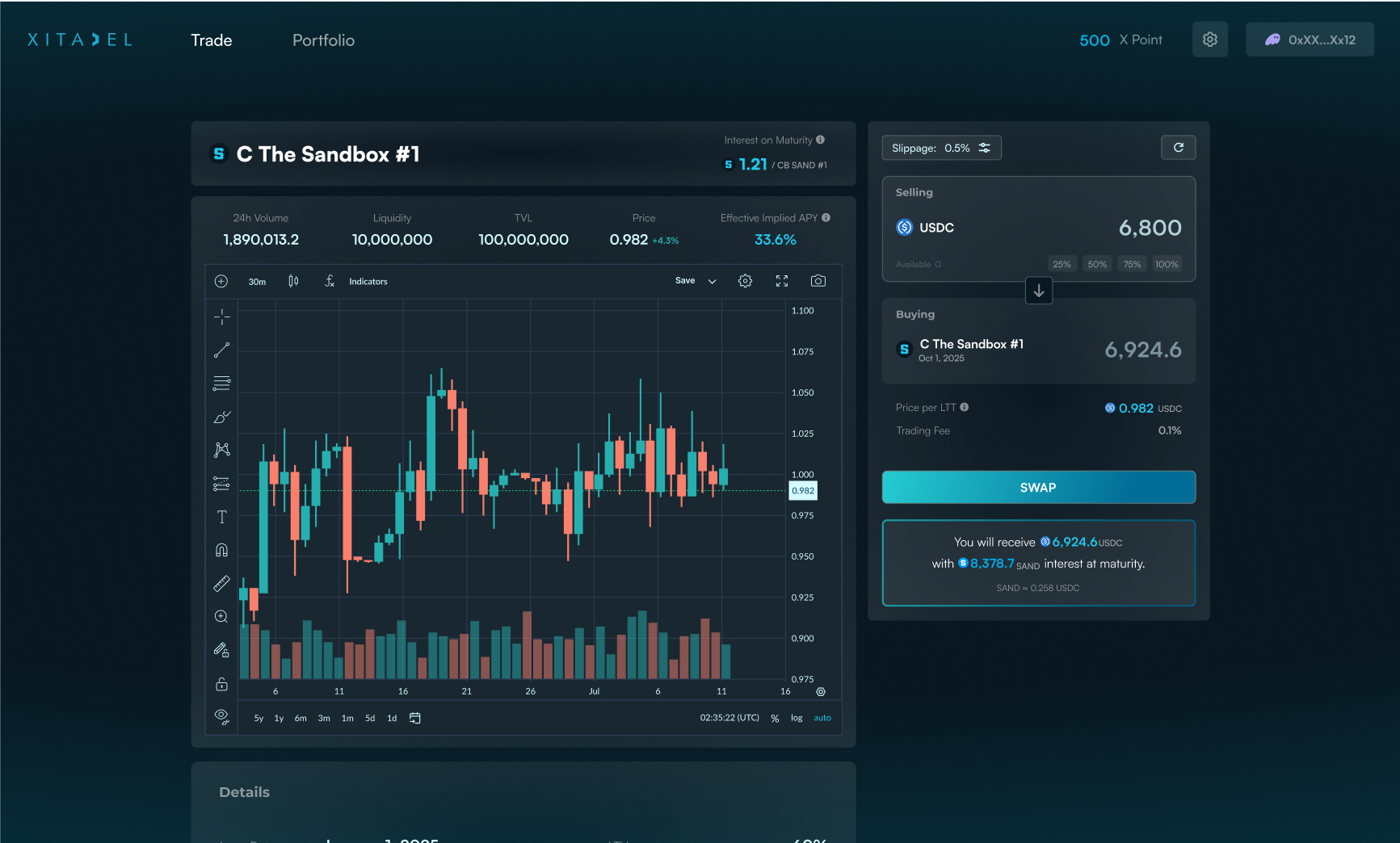

Trading LTT

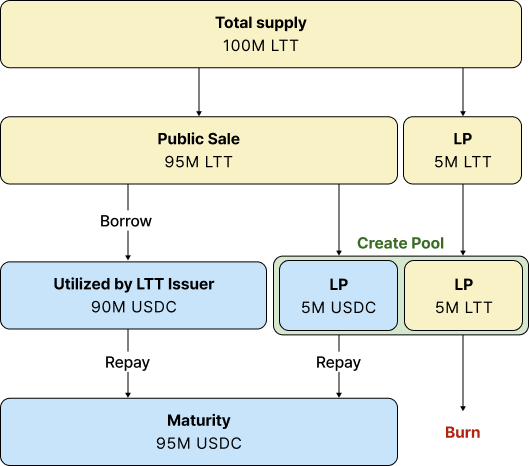

Xitadel builds DEX market into every LTT issuance by utilizing slice of tokens is paired with an equal value of stablecoins in an AMM liquidity pool, letting investors trade LTTs at market-driven prices.

With that 5% allocation, Xitadel sells the remaining 95% of LTTs to investors and deposits the 5% slice plus an equal value of stablecoins into the LP. Because each LTT redeems for principal and interest at maturity, pool prices track yield, time to maturity, and perceived credit quality in real time.

Before maturity, the issuer must deposit exactly 90 M in principal plus interest on the full 100 M supply. The program rejects any deposit above this ceiling. When the vault holds the required amount, maturity processing begins:

- The program withdraws the LP position and burns every LP-held LTT.

- It adds or removes stablecoins so the redemption vault holds the exact value needed to cover all remaining LTTs in circulation.

- If interest is paid in native tokens, it withdraws the matching native-token amount for the burned LP-held LTTs.

After these adjustments, the LTT status transitions to Matured, and holders can redeem. Any extra value from the LP becomes protocol revenue for Xitadel, so liquidity is never trapped.

Embedding an LP slice in every issuance creates a flexible, market-based secondary market. Issuers gain continuous price discovery and preserved liquidity, while investors can enter or exit positions at almost any time. Transparent pricing and on-chain settlement broaden access to fixed-income opportunities in DeFi.